WuXi XDC Reports Strong Business Updates with Superior Financial Results in 1H 2024: Poised for Future Growth

Revenue surged by 67.6% YoY to RMB 1,665 million

Gross profit surged by 133.4% to RMB 535 million,with a gross profit margin of 32.1%,a 9.0 percentage points increase compared to 1H 2023.

Net profit increased by 175.5% to RMB 488 million,with a net profit margin of 29.3%,a 11.5 percentage points increase compared to 1H 2023.

Adjusted net profit grew by 146.6% to RMB 534 million,with an adjusted net profit margin of 32.0%,a 10.2 percentage points increase in 1H 2023.

The total global customer base expanded to 419,with 71 new customers added in 1H 2024.

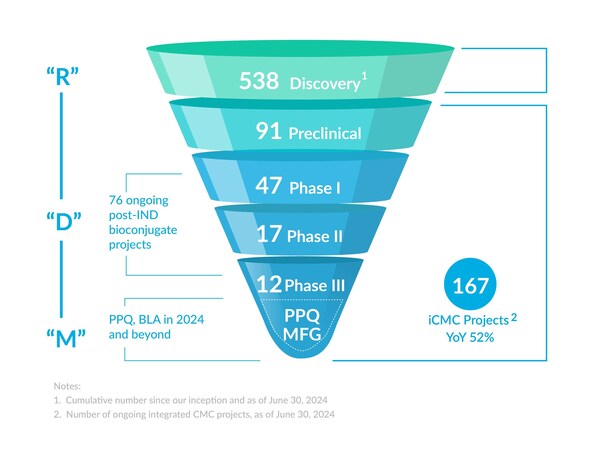

The total number of integrated projects reached 167,with 26 new integrated projects signed.

The number of later stage (phase II and above integrated projects) increased to 29,including 9 PPQ projects from global pharma and biotech customers.

The backlog grew to US$842 million,representing a 105.0% YoY growth.

Continued to drive facility and talent expansion to meet increasing global demands. The Wuxi site ramped up quickly,delivering a 100% success rate to global clients.

The Group received multiple top awards in the "2024 Asia (ex-Japan) Executive Team" by Institutional Investor.

SHANGHAI,Aug. 20,2024 -- WuXi XDC Cayman Inc. ("WuXi XDC" or "the Group",stock code: 2268.HK),a leading global Contract Research,Development and Manufacturing Organization (CRDMO) focused on the ADC andthe other types ofbioconjugate market,is pleased to announce its interim results for the first half of 2024 ("Reporting Period").

Dr. Jimmy Li,CEO of WuXi XDC,stated,"In the first half of 2024,WuXi XDC achieved outstanding financial results and demonstrated strong business momentum. We appreciate all the trust,contributions and support from our employees,customers,investors,and stakeholders. By focusing on customer needs,we actively explore innovative trends in ADCs and new types of bioconjugates,enhancing our technical capabilities and further solidifying our integrated platform. We have expanded the capacity of dual-function production lines and advanced the implementation of "Global Dual-Source" manufacturing strategy. Additionally,we continue to build a strategic talent pool and reinforce quality and compliance training across all staff. With a client-oriented approach,we are delivering high-quality services and solutions,laying a solid foundation for future growth. Looking forward,we are excited by the vast market opportunities in the bioconjugate space. With our leading expertise and integrated capabilities,we are committed to flawless execution and maintain sustainable growth,delivering the superior values to our customers,partners and shareholders."

2024 Interim Financial Highlights

Revenue

The revenue of the Group increased by 67.6% YoY from RMB 993.5 million for the six months ended June 30,2023,to RMB 1,665.2 million for the six months ended June 30,2024. This increase was primarily attributable to (i) the growth in the number of customers and projects,driven by rapid growth of the global ADC and broader bioconjugates outsourcing service market and the Group's established position as a leading ADC CRDMO service provider in that market and (ii) the advancement of the Group's projects into later stages.

Gross Profit and Gross Profit Margin

The Group's gross profit increased by 133.4% YoY to RMB 535 million,driven by (i) the increase in revenue resulting from the increased demand for the Group's services,(ii) the quickly ramp-up and reached high utilization in both DS and DP,and (iii) the optimized cost control and procurement strategy.

Net Profit and Net Profit Margin

The net profit for the period increased by 175.5% YoY to RMB 488 million. Net profit grew faster than revenue and business growth,mainly attributed to significant increase in revenue,coupled with improvement in operation efficiency and more effective and reasonable cost control measures,resulting in higher net profit margin. The net profit margin of the Group is 29.3%,a 11.5 percentage points increase compared to 1H 2023.

Adjusted Net Profit and Adjusted Net Profit Margin

Adjusted net profit for the period increased by 146.6% YoY to RMB 534 million. The margin of adjusted net profit improved to 32.0%.

Customers and Projects Highlights

Our rapidly expanding and high-quality customer base has reached a cumulative total of 419,including high profile and innovative global customers. Collectively,our clients have submitted 71 INDs with the strong support of our Group. Notably,13 out of TOP 20 global pharmaceutical companies (ranked by 2023 revenue) and 4 of the 7 ADC companies nominated by ClarivateTM as "ADC Companies to Watch" have actively partnered with us in various stages of projects.

The "Enable,Follow and Win the Molecule" strategy continued to drive sustained and rapid project growth. The total number of integrated projects is 167,with 26 newly signed integrated projects.

Later-stage projects (Phase II and III) increased to 29,with 9PPQ projects. Anticipating potential BLA submissions in 2024 and beyond to facilitate ADC commercialization success.

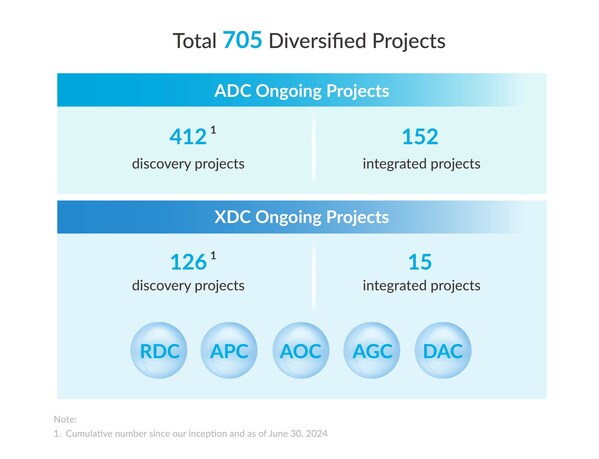

The Group has a diversified project base with a total of 705 projects,covering both innovativeADC and broader bioconjugate (XDC) projects. The total number of integrated ADC projects reached 152. The number of integrated XDC projects increased to 15.

Platform Innovation to Empower R&D

The Group strives to empower customers with cutting-edge conjugation and payload-linker technologies,along with extensive process development expertise to fulfill diverse R&D requirements. The proprietary WuXiDARx™ technology aims to meet clients' demands to develop highly homogeneous ADCs with a range of distinct DAR values.

The Group is committed to meeting the diverse and transformative needs of the global industry. In the first half of 2024,the Group has achieved a remarkable milestone by successfully delivering over 11,000 bioconjugate molecules accumulatively.

The Group has extensive expertise in new formats ofbioconjugates beyond ADCs. The number of XDC discovery projects reached 126,covering multiple innovative targets and novel modalities.

Capacity Expansion and Business Operation Upgrade

The Group has adopted a centralized quality assurance system across its "All-in-One" manufacturing facilities in Wuxi site,further guarantee the product quality. By leveraging "All-in-One" facilities and expertise,the Wuxi site has ramped up quickly and delivered a 100% success rate to global clients.

In response to the strong and increasing global demands,the Group quickly initiated build-up ofmAb/DS dual functional line (BCM2 L2) just after the first dual production line (BCM2 L1) released in Sept 2023. The new mAb/DS line is expected to be operational by Q4 2024,and DP line (DP3) is under construction and expected to be operational by Q2 2025.

The Singapore site broke ground in March 2024 and construction is on track to be operational by late 2025 /early 2026.

The total number of full-time employees increased by 72.2%YoY to 1,496 in the Group,driven by rapid business growth.

All of the Group's manufacturing operations are conducted in accordance with theGMP regulations set by FDA,EMA and NMPA,ensuring the high-quality manufacture of innovative bioconjugate products. The Group has completed more than 110 GMP audits from global clients,including 11 audits by EU Qualified Persons.

During the reporting period,the Group's marketing efforts have expanded and diversified into extensive global marketing initiatives to enhanceWuXi XDC's global presence and strategically drive business opportunities.

Under the lean principal guidance,the Group actively implements theWBS (WuXi Business System) and its lean management system,focusing on continuous improvement as a core objective. Our efforts are dedicated to enhancing capabilities across multiple dimensions,including quality,processes,cost,and operational efficiency.

Key Financial Ratios